84.1% of IT Clients Say Fixed Pricing Is Their Preferred Model for Stability

TechBehemoths conducted a global survey (May 30–June 6, 2025) exploring key areas of digital payments: models, methods, platforms, and processing

BERLIN, GERMANY, July 17, 2025 /EINPresswire.com/ -- TechBehemoths, a platform that connects tech companies and service providers with projects, conducted a worldwide survey between May 30 and June 6, 2025.The survey collected insights from 1,050 B2B service providers in 48 countries to understand how businesses are adjusting to the changing digital payments environment and developing efficient systems for payment processing, billing, and pricing.

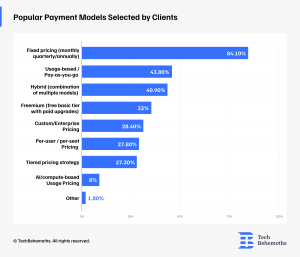

Survey Finds 84.1% of IT Clients Choose Fixed Pricing for Stability and Simplicity

TechBehemoths' survey finds that fixed pricing models are the most widely used by IT clients, preferred by 84.1% for their predictability. Usage-based (43.8%) and hybrid models (40.9%) are also common, offering greater flexibility. Freemium pricing, used by 33%, is popular for SaaS products, while custom/enterprise (28.4%) and per-user/per-seat pricing (27.8%) are typical in B2B software. Tiered pricing is used by 27.3%, and AI-based models remain niche at 8%. Only 1.8% employ alternative strategies, indicating a heavy dependence on pre-existing pricing schemes.

The Freemium Pricing Model is the Fastest-Growing Choice Among IT Companies’ Clients

According to TechBehemoths' survey, the freemium pricing model is the fastest-growing among IT companies’ clients, now used by 41.1%, especially in SaaS and digital products. Fixed pricing (38.9%) and usage-based models (37.7%) remain popular for their predictability and scalability. Hybrid models have reached 33.1% adoption, while AI-based pricing is rising at 23.4%. Traditional models like per-user (18.3%), tiered (16%), and custom pricing (12.6%) are experiencing slower growth.

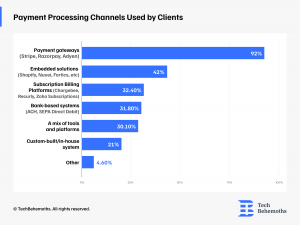

92% of IT Clients Choose Stripe, Razorpay, and Adyen as Preferred Payment Gateways

The survey shows that most IT companies’ clients rely on trusted, widely adopted payment platforms, with 92% using gateways like Stripe, Razorpay, or Adyen for their global reach and integration ease.

The list also includes other frequently used solutions such as:

- Embedded payment systems (42%), such as Shopify or Nuvei, are popular among e-commerce businesses

- Subscription billing platforms (32.4%), like Chargebee and Zoho Subscriptions, for managing recurring payments

- Bank-based systems (31.8%), including ACH and SEPA, are used for direct debit transactions

Additionally, 30.1% of IT clients combine multiple tools for complex or regional needs, and 21% use custom or in-house systems to meet specific requirements. Only 4.6% use other methods, showing a preference for reliable, scalable payment systems.

Stripe, PayPal, and Shopify Payments are Top Integration List for IT Companies

Survey data shows that Stripe (80.1%) and PayPal (74.3%) are the most commonly integrated payment platforms among IT companies, with Shopify Payments (41.5%) also widely used, particularly in e-commerce.

Among other payment platforms used are:

Square and Klarna – 17% each

Braintree – 15.2%

HubSpot Payments and Mollie – 8.8% each

BitPay – 7.6%

Adyen – 5.8%

Helcim – 2.3%

An additional 7.4% of IT companies also use alternative payment platforms to meet specific needs.

Nearly 90% of IT Companies Rely on Card Payments for Seamless Integration

The recent industry survey states that credit and debit cards are the most commonly integrated payment methods in IT client projects, used by 89.8% of companies due to their global acceptance and familiarity. Digital wallets like Google Pay and Apple Pay, as well as bank transfers and direct debit, are also widely used, with 68.8% of implementations. National digital payment networks like UPI (India) and iDEAL (Netherlands) grow at 29.5%, while 20.5% of companies support cryptocurrencies, mostly in niche sectors. Only 0.9% reported using other methods.

Billing Failures Top IT Concerns, with 46.2% Reporting Issues in Payment Processing

Based on TechBehemoths' survey, the top technical challenges IT companies face in billing setup are identified, with 46.2% reporting poor handling of failed or declined payments as the leading issue.

Additional frequent technical challenges are:

- Integration with third-party payment providers (43.2%)

- Syncing billing with internal tools like CRMs and analytics platforms (36.1%)

- Invoicing accuracy, tax handling, API limitations, and documentation issues (28.4%)

- Lack of real-time reporting and visibility into billing errors or churn

- Complex per-user or seat-based billing logic (18.9%)

Only 0.8% reported other challenges, suggesting most difficulties fall into a well-defined set of recurring issues.

What is TechBehemoths?

TechBehemoths is a German-made platform that connects IT companies with clients around the world. It focuses on innovation, collaboration, and growth. TechBehemoths helps businesses find the right partners to succeed in the competitive global market. Today, the platform features over 55,000 companies from 143 countries.

Marcel Sobieski

Mobiteam GmbH

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

X

Distribution channels: Business & Economy, Companies, IT Industry, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release