IBN Technologies Propels Outsourcing Accounts Payable Services in the USA with Innovative Financial Solutions

outsourcing accounts payable services by IBN Technologies streamlines payments, cut costs, and improves financial control for U.S. businesses.

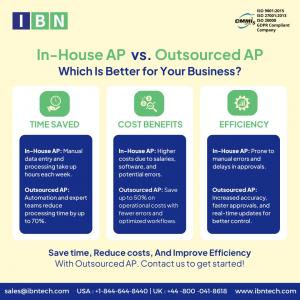

MIAMI, FL, UNITED STATES, June 19, 2025 /EINPresswire.com/ -- Manual processes in finance departments continue to challenge many U.S. businesses, leading to delays and inefficiencies in handling invoices and payments. Business owners and accounting teams are increasingly outsourcing accounts payable services to improve accuracy and streamline payment cycles. This approach helps companies manage fluctuating workloads while controlling cash flow and vendor relationships. Outsourcing AP services is quickly becoming a preferred strategy to boost operational efficiency and focus internal resources on core growth areas.Manual workflows also increase exposure to errors and fraud, making it vital for organizations to Address Accounts Payable Risks head-on. Partnering with specialized providers delivers consistent processing, faster payments, and stronger compliance controls. Sectors like manufacturing, healthcare, and professional services are embracing this trend as part of broader efforts to strengthen financial operations. Outsourced accounts payable are now a key tool in driving business resilience and financial transparency.

Streamline your AP process—book your free consultation now!

Get a free Consultation: https://www.ibntech.com/free-consultation-for-ap-ar-management/

Operational Risks in Manual Accounts Payable

Manual accounts payable processes introduce inefficiencies and financial risks for many businesses. Dependence on manual data entry and paper-based invoices increases the likelihood of errors and delays, impacting cash flow management and supplier relationships.

Key challenges include:

1. Data entry errors causing invoice mismatches and reconciliation delays

2. Limited visibility into invoice status and accounts payable aging

3. Risks of duplicate payments and missed due dates affecting vendor confidence

4. Insufficient audit trails increasing compliance exposure

5. Scaling difficulties during high transaction volumes leading to processing bottlenecks

To address these challenges, many finance teams are turning to outsourced accounts payable services from providers like IBN Technologies. These services utilize outsourcing, real-time invoice tracking, and standardized workflows to manage payables efficiently while supporting operational continuity.

Enhancing Accounts Payable Accuracy

Efficient management of accounts payable is essential for maintaining financial control and operational consistency. Businesses seeking to improve accuracy, reduce processing time, and ensure compliance are increasingly exploring outsourcing as a strategic option.

✅ Accurate recording of purchase orders, invoices, and goods receipt notes ensures dependable financial data.

✅ Unauthorized or non-budgeted purchase orders are identified and resolved to maintain budget discipline.

✅ Invoice processing from receipt through payment is efficiently managed to guarantee timely and accurate transactions.

✅ Vendor records are meticulously maintained with clear communication to support smooth transactions and prompt payments.

✅ Business expenses are closely monitored and controlled to optimize cash flow and reduce unnecessary costs.

✅ Payment execution is conducted in strict compliance with contracts to prevent late fees.

✅ Regular account reconciliations confirm accuracy and adherence to financial regulations.

✅ Reporting and analytics provide insight into accounts payable performance and spending trends to support informed decisions.

Outsourcing AP services offer a solution by combining expert oversight, and streamlined workflows. Providers like IBN Technologies enable businesses to strengthen payables management while focusing on strategic growth.

IBN Technologies’ Outsourced Accounts Payable Services

Outsourcing accounts payable is emerging as a strategic choice for businesses aiming to streamline financial operations, reduce costs, and ensure timely, accurate payments. With specialized support, companies maintain efficient, compliant AP processes while dedicating more focus to core business activities.

1. Accurate management of vendor and customer data to facilitate seamless payments

2. Improved collection rates coupled with reduced risk of bad debt

3. Consistent ledger updates aligned with GAAP requirements

4. Clear cash flow forecasting enabling stronger financial oversight

5. Accelerated invoice processing with minimized errors, demonstrating the tangible benefits of accounts payable outsourcing

Proven Impact on Accounts Payable

Outsourcing AP services continue to deliver improved results as more companies partner with experts like IBN Technologies. These collaborations provide measurable benefits, including:

1. Faster invoice processing and optimized payment schedules help clients increase cash flow efficiency by up to 40%.

2. Streamlined approval workflows and efficient outsourcing reduce expenses related to manual processes, generating significant savings.

3. Timely and accurate payments build supplier trust, leading to stronger partnerships and better contract terms.

These outcomes demonstrate how outsourcing accounts payable services with trusted providers like IBN Technologies strengthens financial control and operational effectiveness.

Advanced AP Outsourcing with IBN Technologies

Growing interest in outsourcing accounts payable services is prompting companies to seek adaptable, technology-enhanced approaches that support competitiveness. The next phase of AP outsourcing will rely on integrating sophisticated security measures, live data insights, and innovative tools that boost visibility and operational control. Organizations leveraging these capabilities will manage complex payment landscapes more effectively, respond rapidly to market dynamics, and improve cash flow while mitigating operational exposures.

Amid these shifts, IBN Technologies provides personalized solutions aligned with evolving compliance and sector demands to optimize the Accounts Payable Procedure. By improving process efficiency and enabling scalable growth, these collaborations elevate accounts payable beyond basic transactions to become strategic levers for financial flexibility and sustainable expansion. IBN Technologies' deep process expertise ensures seamless execution and readiness for future challenges.

Related Service:

Outsourced Finance and Accounting

https://www.ibntech.com/finance-and-accounting-services/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release